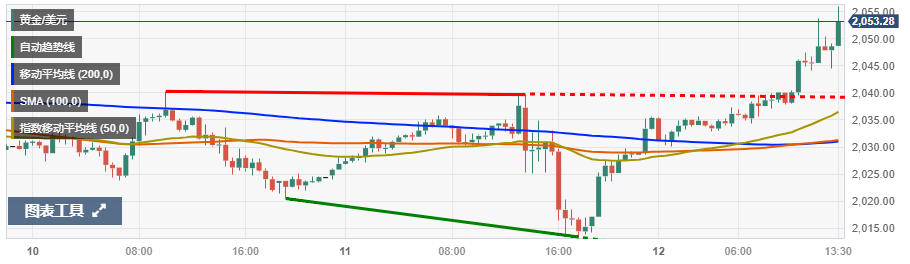

PPI weakens across the board, gold breaks through the 2050 mark and is expected to test 2100!

US Producer Price Index (PPI) across the board lower than expected, the swap market has digested more Fed rate cuts in 2024, and gold bulls are poised to take the 2050 mark.

Time:

2024-01-13 08:10

Huitong Finance APP News— United States Producer Price Index (PPI) across the board lower than expected, the swap market digested 2024 Federal Reserve More rate cuts, gold bulls poised to take the 2050 mark.

On Friday (January 12), newly released data showed that the December PPI month-on-month rate was -0.1%, expected 0.10%; the December PPI year-on-year rate was 1%, expected 1.30%. At the same time, the December core PPI month-on-month rate was 0%, expected 0.20%; the December core PPI year-on-year rate was 1.8%, expected 1.9%. After the data release, traders raised the Fed's 2024 rate cut expectations from 154 basis points to 160 basis points.

These figures contradict Thursday's Consumer Price Index (CPI) data, which showed a rise in overall inflation on Thursday. The PPI data released today is below almost all expectations and reveals a gap between what end consumers pay and what producers actually pay.

Market reaction:

Gold prices benefited from tensions in the Middle East and gained new momentum from the PPI. After the data release Spot gold rose sharply in the short term by nearly 5 US dollar , currently at $2052.91 per ounce.

COMEX most active gold futures contract Beijing time January 12, 21:30--21:31 within one minute of the trading volume instantly traded 2499 hands, the total value of the trading contract is $514 million.

Mixed US consumer inflation data fueled expectations that the Fed may delay a much-anticipated rate cut in March, dragging gold prices to a one-month low on Thursday. Gold prices then rebounded on the back of tensions in the Middle East.

Following weeks of attacks on ships in the Red Sea by Houthi rebels, disrupting global shipping, the US and UK launched air strikes against targets of the Houthi rebels in Yemen, targeting radar facilities, storage sites and missile launchers. On Thursday, Houthi rebel leader Abdul-Malik al-Houthi warned that any US attack on the Houthi rebels would be met with a response, and that future counterattacks would be even more intense. A Houthi rebel spokesman said on Friday that US and UK forces had launched 73 attacks on Yemen. The US-UK attacks killed five people. At the same time, it said that Yemen's response is imminent.

Technical Analysis #Gold Technical Analysis#

(Source: FXStreet)

From a technical perspective, the overnight rebound of the 50-day moving average and the subsequent rise, as well as the positive oscillation indicators on the daily chart, are favorable to bullish traders. Nevertheless, before preparing for further gains, it is prudent to wait for a sustained strengthening above the $2,040-2,042 supply area. Subsequently, gold prices may accelerate the momentum of last Friday's volatility high (around the $2,064 area) and eventually rise to the $2,077 area. Some follow-up buying will offset any near-term negative outlook and lay the groundwork for reclaiming the $2,100 integer level.

On the other hand, the $2,022 area now appears to protect against immediate downside below the multi-week low (around the $2,013 area) or the 50-day moving average tested on Thursday. A convincing break below the latter would be seen as a new trigger for bearish traders and would drag gold prices to the $2,000 psychological level. The downward trajectory could extend further to the December volatility low, around the $1,973 area, and then eventually fall to the $1,965-1,963 confluence, including the 100-day and 200-day moving averages.

Related News

Gold prices continue to fluctuate.

Gold prices have shown a volatile pattern in the short term, affected by the weakening of the US dollar and changes in sentiment due to easing geopolitical tensions.

Gold prices rise again! Multiple risks fuel safe-haven demand.

From the perspective of the international market, the tense situation in the Middle East, the escalation of the Russia-Ukraine conflict, and the continued high uncertainty surrounding the US Trump administration's tariff policies have driven up gold prices due to increased risk aversion in the market. Furthermore, a significant recent change in the gold market is that gold has become the second-largest reserve asset for central banks globally. How should the future trend of gold prices be viewed? Several analysts have indicated that in the short term, gold prices may fluctuate due to factors such as tariff easing and sudden changes in the geopolitical situation; in the medium to long term, gold prices are still in an upward channel.

As the Russia-Ukraine conflict enters its third year, global attention is once again focused on this geopolitical crisis. According to Dow Jones Newswires, US President Donald Trump made startling remarks at the White House on Thursday (June 5), stating that neither Russia nor Ukraine is prepared for peace, and that both sides may "continue fighting" until one side is willing to compromise. This statement not only signals the failure of his attempts to broker peace, but also introduces new uncertainty to the global geopolitical and economic markets.

Recently, good news came from the China Machinery Metallurgy and Building Materials Workers' Technical Association. In the 2025 National Machinery Metallurgy and Building Materials Industry Workers' Technological Innovation Achievement Award, Shandong Guoda Gold Co., Ltd.'s "Purification of Crude Arsenic Flue Dust to Produce Arsenic Trioxide Industrial Application" and "Key Technology Application for High-Value Utilization of Complex Copper-Gold Ore Resources" projects won the first prize and the second prize respectively. This honor is a high recognition of the workers' technological innovation ability and the effectiveness of achievement transformation, and also fully demonstrates the company's outstanding strength in the industry.

Gold prices return to $3300! Wall Street banks show significant divergence in long-term outlook

In fact, as gold prices fluctuate, Wall Street's major banks have recently shown a clear divergence in their views on gold prices. Unlike Goldman Sachs and Deutsche Bank, which are optimistic about gold's performance, Citigroup believes that the long-term outlook for gold prices is not optimistic.

Although gold prices rose this week, market volatility has clearly increased. While the US-UK agreement is symbolic, its content is limited and insufficient to alleviate concerns about a global economic slowdown. Therefore, gold prices will continue to fluctuate between safe havens and policy signals, closely monitoring the Federal Reserve's interest rate expectations and global trade sentiment.